How Insurance Works: Understanding the Process

Ever wondered what happens when you Buy Insurance?

Imagine this: You’re driving your car, feeling secure, knowing you have motor insurance to cover any unexpected accidents.

Or you visit a doctor without worrying about hefty bills because your health insurance has your back. This is the power of insurance—helping you stay prepared for life’s uncertainties.

From covering unexpected medical expenses to securing your home, insurance ensures that when life takes a turn, you won’t face financial burdens alone.

Insurance plays a critical role in managing risks and providing financial protection. It’s a promise that when something goes wrong, you won’t have to bear the full financial burden alone. In this blogpost we’ll dive into how insurance works and why understanding it can save you from future headaches.

The Basics of Insurance

At its core, Insurance is all about risk-sharing. Life is unpredictable, and everyone faces potential risks, whether it’s health issues, accidents, or property damage. Insurance is a mechanism for managing risks. It works on the principle of pooling resources.

Here’s how it works:

When you buy an insurance policy, you agree to pay a premium to an insurer. In return, the insurer promises to compensate you for specific financial losses, such as hospital bills, property damage, or even loss of income, depending on the policy you choose.

How Does Risk-Sharing Work?

Insurance companies pool funds collected from all policyholders. This pool is then used to pay claims for individuals who face insured risks. For example, if 1,000 people pay premiums for car insurance, the funds can cover repairs for a few unfortunate policyholders involved in accidents.

The Process of Insurance

Understanding the journey from buying an insurance policy to receiving compensation is essential and involves several key steps. Let’s break it down:

“Learn how insurance works, from buying a policy to filing a claim. This guide simplifies the process of insurance for beginners.”

1. Buying an Insurance Policy

The first step in the insurance process is purchasing a policy that suits your needs. To do this, you must assess your risks and priorities. For instance, if you’re a young professional, health insurance might be your top priority. For a homeowner, property insurance becomes vital.

Once you identify your needs, compare various insurers and policies. Look for factors like coverage options, premium amounts, claim settlement history, and customer reviews. Choosing the right policy is a crucial decision—it determines the extent of financial protection you receive.

2. Paying Premiums

Paying premiums is the backbone of maintaining an active insurance policy. A premium is the amount you pay periodically to the insurer.

How Are Premiums Calculated?

Premiums Depend on risk Factors like your age, lifestyle, location, and the type of insurance. For instance:

- Health insurance premiums are higher for older individuals or those with pre-existing medical conditions.

- Car insurance premiums may increase if you drive in high-risk areas or own a luxury vehicle.

- Premiums can be paid monthly, quarterly, annually, or as a one-time lump sum, depending on the policy terms.

3. Understanding Policy Terms and Coverage

Insurance contracts can be complex, but understanding their terms is critical.

Key Components of a Policy:

Coverage: Specifies what is covered (e.g., hospitalization, accidents, theft).

Exclusions: Lists events or conditions not covered (e.g., cosmetic surgeries, intentional damage).

Riders: Optional add-ons that enhance coverage (e.g., critical illness coverage in health insurance).

Always read the fine print and clarify doubts with the insurer to avoid surprises during claim settlement.

4. Filing a Claim

When an insured event occurs, filing a claim is how you access the benefits of your policy.

How to File a Claim:

- Inform your insurer immediately after the incident.

- Submit required documents, such as bills, receipts, police reports, or medical records.

- Wait for the insurer to verify your claim and process the payout.

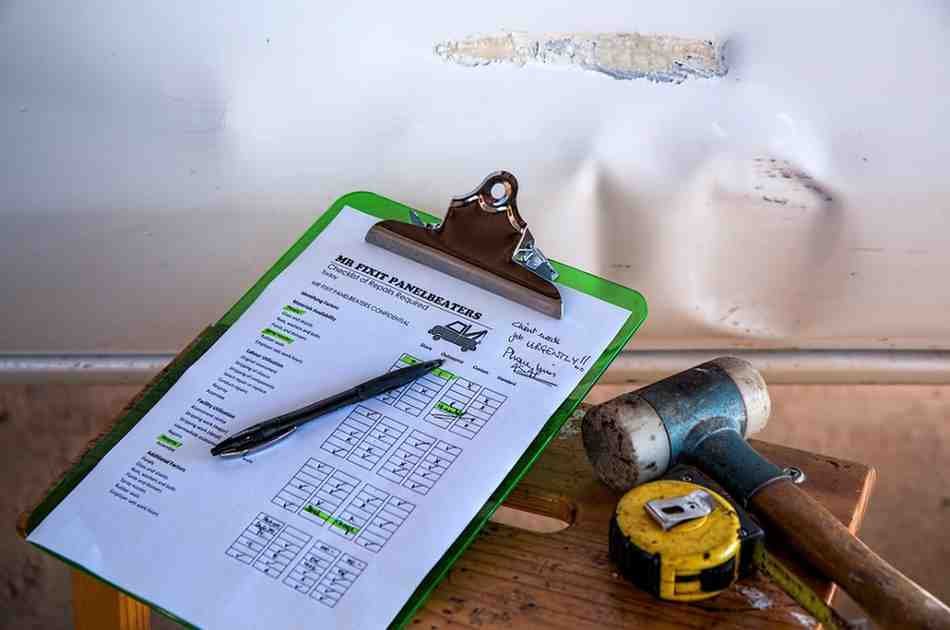

For example, in motor Insurance, you may need to provide an accident report and photographs of the damage to file a claim.

5. Receiving the Payout

Once your claim is approved, the insurer will provide financial compensation.

In health insurance, payouts may be made through cashless transactions (where the insurer directly pays the hospital) or reimbursement (where you pay upfront and get reimbursed later).

The payout process ensures you’re financially supported during critical times, helping you recover without additional stress.

How Insurance Works

Insurance works on the principle of risk-sharing. It pools resources from many policyholders and uses these funds to provide financial support to those who face covered risks. When you buy an insurance policy, you enter into a contract with the insurer.

You agree to pay premiums regularly, and in return, the insurer promises to compensate you for losses caused by specified events, like accidents or illnesses.

How Insurance Works in India

In India, Insurance serves as both a protective and investment tool. It operates under regulations set by the Insurance Regulatory and Development Authority of India (IRDAI), which ensures fairness and transparency in the industry.

Key features of how insurance works in India:

Premium Payments: Premiums are typically low for government-backed schemes like PMJJBY (Pradhan Mantri Jeevan Jyoti Bima Yojana), making them accessible to a larger population.

Diverse Options: India offers a wide range of insurance options, from health and life insurance to crop insurance for farmers.

Tax Benefits: Insurance premiums often qualify for tax deductions under Sections 80C and 80D of the Income Tax Act.

Claim Processes: Insurers are required to settle claims promptly to ensure customer satisfaction.

For example, Government schemes like Ayushman Bharat provide free health coverage to economically weaker sections, showcasing how insurance in India is tailored to meet diverse needs.

How Insurance Policy Works

An insurance policy is a legal contract between the policyholder and the insurer. It outlines the terms of coverage, including what is covered, exclusions, and the duration of the policy.

Here’s how it works:

1. Buying a Policy:

The policyholder selects a policy based on their needs (e.g., health, motor, or life insurance).

After comparing options, the individual pays the premium to activate the policy.

2. Coverage and Terms:

The policy specifies the events or risks covered, like accidents or medical emergencies.

It also lists exclusions—events not covered, such as intentional damage or pre-existing illnesses.

3. Claim Process:

In case of a covered event, the policyholder files a claim with necessary documentation.

If the claim is valid, the insurer compensates the policyholder.

4. Renewal:

Most policies require renewal after a specific period (e.g., annually). Failing to renew may result in the loss of coverage.

Understanding your policy’s fine print is crucial to ensure you know what to expect during claims.

How Insurance Companies Work

Insurance companies operate as financial institutions that manage risks for individuals and businesses. Their primary objective is to pool risks, manage funds, and provide timely payouts.

Here’s how they work:

1. Risk Assessment:

Insurance companies assess the risk profile of applicants before issuing policies.

Higher-risk individuals or assets may attract higher premiums.

2. Pooling Funds:

Premiums collected from policyholders are pooled into a common fund.

These funds are then used to pay claims or invested to generate returns.

3. Claim Management:

When a claim is filed, the insurer evaluates its validity by reviewing the documents and circumstances.

Genuine claims are processed and compensated as per the policy terms.

4. Compliance and Regulation:

In India, insurers operate under strict guidelines set by the IRDAI to ensure customer protection.

5. Profit and Sustainability:

Insurance companies aim to balance claim payouts with income from premiums and investments. This ensures financial stability and profitability.

Insurance Companies are the backbone of the Insurance Ecosystem, making it possible for individuals and businesses to mitigate risks efficiently.

Why Understanding the Insurance Process Matters

Knowing how Insurance Works can make a significant difference in your financial planning. Misunderstanding policy terms or ignoring Exclusions can lead to claim denials.

- Avoiding Claim Rejections: By understanding exclusions and documentation requirements, you reduce the risk of claim denials.

- Maximizing Benefits: Familiarity with policy terms ensures you take full advantage of available benefits, such as tax deductions or add-on riders.

For instance, in India, premiums paid for health insurance are eligible for tax benefits under Section 80D of the Income Tax Act. Similarly, understanding riders can help you customize your policy for better coverage.

FAQs About How Insurance Works

1. What happens if I stop paying my premiums?

If you stop paying premiums, your policy will lapse, and you’ll lose coverage. Some insurers offer a grace period to renew the policy, but it’s best to avoid interruptions.

2. Can I transfer my policy to another insurer?

Yes, many policies allow portability. For example, in health insurance, you can transfer your policy to a new insurer while retaining benefits like a no-claim bonus.

3. What are the most common reasons for claim rejection?

Claims may be rejected due to incomplete documentation, attempting to claim for exclusions, or filing the claim after the allowed timeframe.

Conclusion

Insurance simplifies the uncertainties of life, ensuring you’re financially prepared for any surprises. From understanding the basics to navigating the claim process, being informed about insurance helps you avoid pitfalls and maximize benefits.

Whether it’s safeguarding your family’s health, protecting your car, or securing your Property, insurance provides peace of mind and stability in an unpredictable world.